What does this chart show?

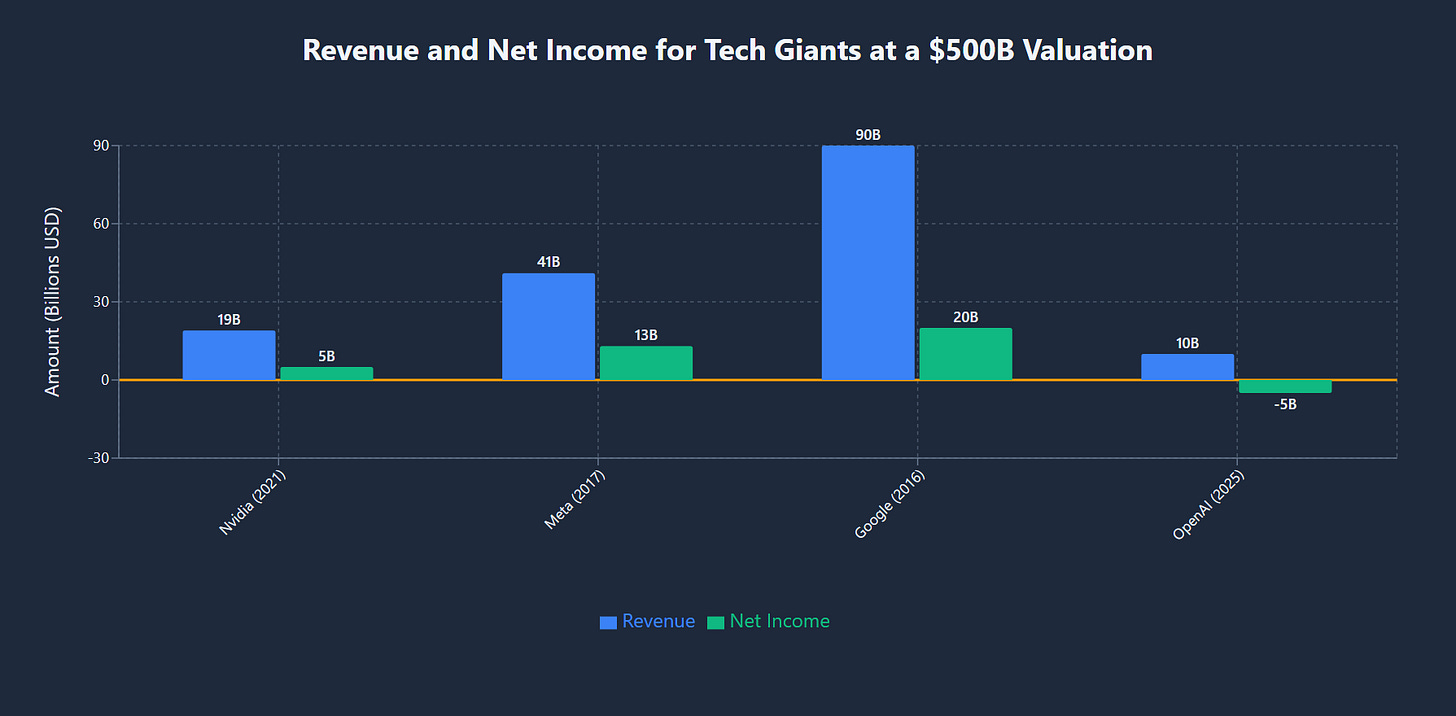

The revenue and net income of some of the major tech giants when they had a $500B valuation (OpenAI is rumored to be on the verge of raising money at this valuation).

Why does it matter?

The financial quality of OpenAI relative to past big tech winners when they commanded a $500B valuation is unprecedented, but so is the user and revenue growth of the business. This year OpenAI’s revenue is tracking to quadruple with one billion weekly users, a user rate that took Facebook eight years to reach.

The valuation seems to reflect the high probability that OpenAI is in poll position to be the winner in consumer facing artificial general intelligence, and/or super-intelligence, and that the capital intensity of the business will come down over time.

The Bottom Line

OpenAI appears to be the most valuable unprofitable company of all time, but also is the fastest company to grow to $10B in revenue. Enormous expectations are embedded in the current valuation.

Data Sources : Brad Gerstner, Financial Times