Thematic investing gained popularity in the past few years as funds were formed to provide investors concentrated exposure to niche and developing areas of the market - marijuana, electric vehicles, green energy, and genomic innovation are examples. As the tide has gone out in markets many of the companies in these funds have been exposed as expensive, profitless and speculative during a time when cash flow has become important again.

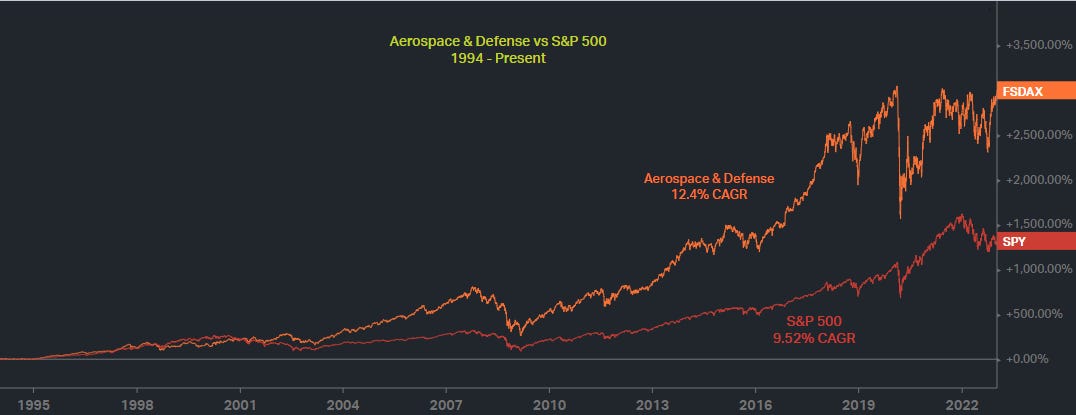

There is one enduring investment theme, however, that is often overlooked but has a record of consistent broad market outperformance - aerospace and defense. The experts claiming that globalization would mark the end of columns of tanks rolling across borders have tragically been proven wrong. War has been a constant throughout the history of civilization and U.S companies operating in the aerospace and defense sector have been beneficiaries. The chart above highlights an impressive 30 year record of outperformance of aerospace & defense over the S&P 500.

There are a few reasons to believe that defense will continue to serve as an attractive thematic investment. The leading defense primes have an oligopolistic hold over government contracts and sport healthy balance sheets and strong cash flow. The past 50-year average U.S spending on defense has been 4.3 percent of GDP and despite projected downtrend in that average, a renewed emphasis from our allies to acquire U.S defense technology (Javelin missiles, HIMARs) will drive demand alongside a domestic commitment to spend on defense innovation.

Consider the merits of aerospace & defense as an enduring and timeless theme.

Note - In this chart I use Fidelity’s Aerospace & Defense fund FSDAX as a broad proxy because it has a long history and can illustrate the point. Another similar fund from iShares, ITA, has also outperformed the S&P since its inception in 2006.