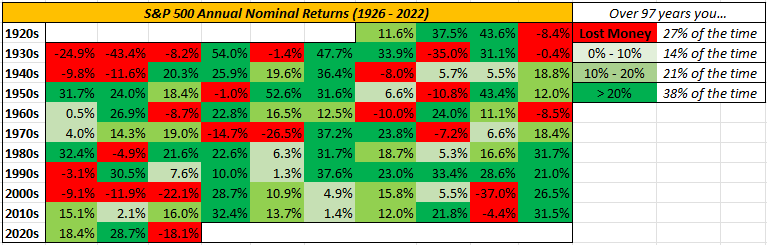

What does this chart show?

The annual returns of the S&P 500 by year, sorted by decade. Over the 97 years observed, 27% of the time the S&P 500 posted negative returns. 38% of the time the S&P 500 posted returns in excess of 20%.

Why does it matter?

Humans crave certainty, so we seek it out in predictions which are really hard to get right. Sometimes investors are told to expect the long run average return of the S&P 500, between 6-7%. Other times they’re told Capital Market Assumptions, a rigorous analysis that sets future expectations based on current and estimated conditions.

Ultimately, these are all best-guesses and they’re usually far from the year-to-year lived experience of investors. Most expert predictions that inform expectations are tightly clustered together, often close to the long run average. They are often grossly wrong because of unexpected major events - pandemics, debt bubbles bursting, emerging innovation, wars, shifts in monetary policy, inflation.

What investors in stocks are likely to experience, if history is any guide, is a roller coaster ride. Over the last ~100 years, investors in the S&P 500 most often saw returns >20% in any given year! And lost decades happen, 0% nominal returns per year on average, just look at the 2000s. The highs are high and the lows are low.

The Bottom Line

Returns that seem abnormal, when one expects long term averages or Capital Market Assumptions, are actually quite normal. Over short time periods, stock market prices are driven by fear of the unknown or the projection of a euphoric future forever. Over the long term an investment in stocks is an investment in human ingenuity, drive, and self interest that will earn you a nice return, but one that can’t be predicted in any given year - expect a thrilling ride.