A softer than expected CPI print and a slowdown in the pace of Fed hiking has some wondering if the worst of the stock market is behind us. 60% of respondents to Deutsche Bank’s recent survey of professional investors see the S&P 500 moving higher in 2023. Taking a look back at past inflation-driven bear market troughs helps provide perspective. Is the bottom in? If not, when could it be?

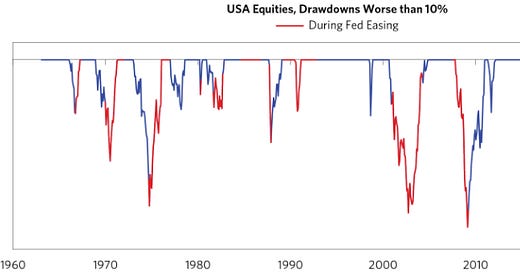

While some investors may believe that equity markets price in recessions ahead of time, history shows that equities bottom well after the recession begins. As demonstrated in the chart, many of the most significant drawdowns and later bottoms have occurred during periods when the Fed is easing - see 1970, 1974, 1982, 1987, 1991, 2002, 2009. This pattern also holds in international equity markets.

It appears that our current equity market drawdown is simply a function of higher rates, not recession risk. Growth still appears roughly normal, employment is very strong, and inflation is way too high. These conditions call for continued hiking, not a pivot.

At this point pivoting would probably require a deterioration in employment sufficient to bring inflation down to target, setting conditions that would warrant easing. Of course nobody knows when that will be, but the market seems to think late next year or early 2024. If history is a teacher we aren’t likely to see a bottom in stocks until some point after then.

Chart source - Bridgewater Associates