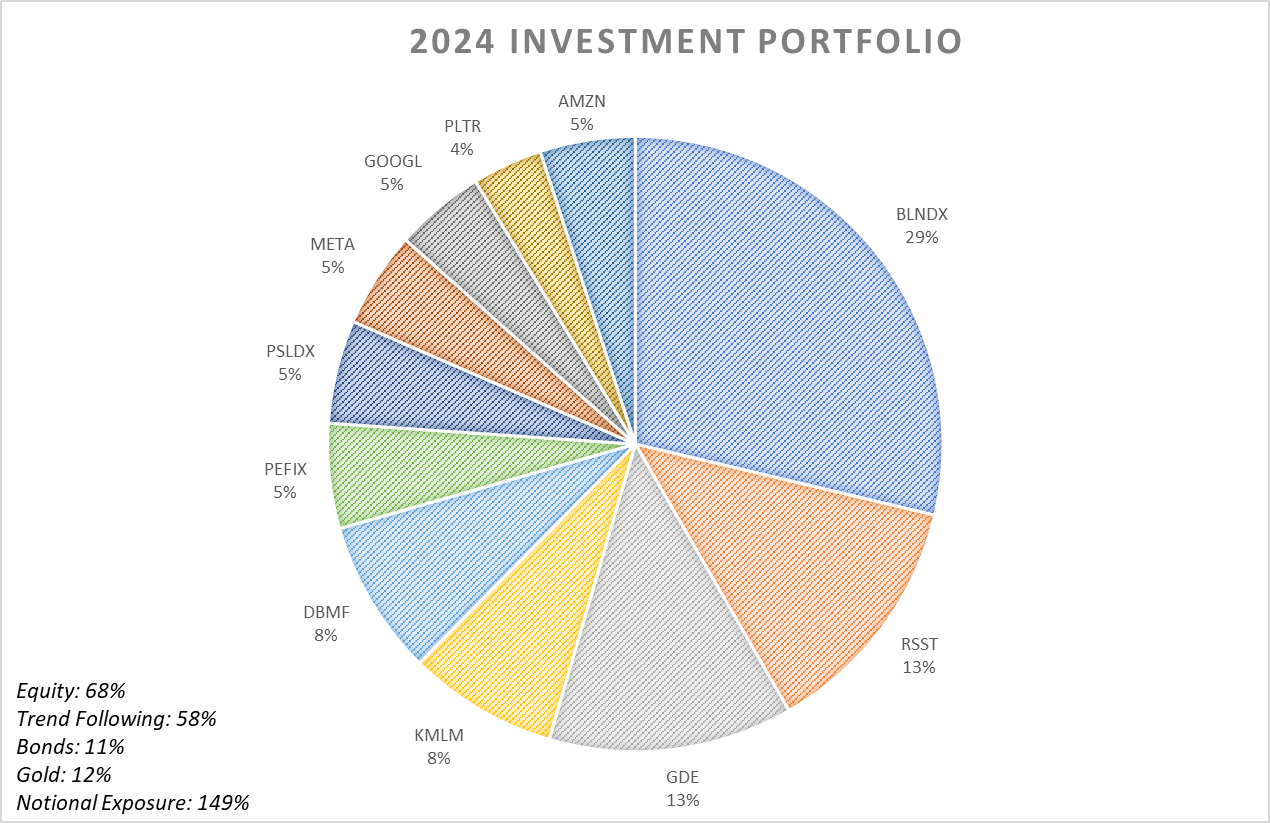

Last year I wrote about how I invest and why. It was a good way for me to think about the principles of good portfolio construction, review my own portfolio, and write it all down. This is going to be an annual thing for me to reflect on and share. For further context, I recommend checking out last year's portfolio here, and you can see the 2024 portfolio below. The goal for my personal portfolio is to outperform global equities with a lower maximum drawdown than a 100% global equity portfolio over a 30-year period.

I continue to believe:

-That almost nobody has ‘edge’, or alpha, and the majority of those that do, don’t want your money. The select few that do have edge and are willing to give you access are ruthlessly efficient at taking it all for themselves in the form of fees.

-That fee reduction is the purest form of alpha (credit Andrew Beer).

-That capital efficiency is the most underrated investing concept, and best used to enable more diversification.

-In holding stocks for the long-run, and that trend-following is the best diversifier to equity beta. The combination of the two creates a durable portfolio for any macroeconomic environment.

-That preparation > prediction

Investment Selection

I provided background on many of the funds in the portfolio in last year's post. Below I add some further commentary on certain funds and stocks.

One note - asset location is very important, BLNDX, PSLDX, and PEFIX are in a tax advantaged account.

BLNDX: I continue to think BLNDX may be the best single fund available to retail investors. It’s created by an incredible CIO, Eric Crittenden. Under the hood there’s global equities + trend following for ~150% notional exposure. This video walks through performance year by year. If it was prudent to give all my money to any one manager, I’d probably give it all to Eric.

RSST & GDE: Both funds provide the portfolio great capital efficiency. Under the hood of RSST is equities + trend-following, with 200% notional exposure. It’s created by another great CIO, Corey Hoffstein.

Under the hood of GDE is equities + gold, with 180% notional exposure. Gold is an asset that I wanted more direct exposure to. It’s a powerful portfolio diversifier, and I think it will become an increasingly important asset given our fiscal recklessness and because we’ve weaponized the dollar against our foes.

My single stock positions: The big tech behemoths are likely the best businesses ever created. They have monopolistic positioning in their respective industries, giving them immense moats, and they delight (addict?) customers. I think it’s probable that AI will become a sustaining technology, further entrenching the position of the big tech giants. They have the cash to buy the GPU’s, compute and infrastructure that AI will require, and they have the world's best talent. They’ve already created incredible open-source large language models that will pose major challenges to upstart competitors and they’re embedding AI in their products. The ZIRP/COVID helicopter money era made them somewhat complacent, especially in their headcount. This is reversing and higher interest rates have refocused them. I’m confident they will continue to grow earnings and free cash flow at an increasing clip and outperform equity indices.

In looking for exposure to big tech, my priority was to purchase the companies that I believed had the best moats at good-to-fair valuations. I bought META back when everyone thought Mark Zuckerberg was a dead-man and the stock was trading at deep-value levels towards the end of 2022. He continues to be a killer and is an exceptional leader - see this video. This has been my best single investment ever so far.

I bought GOOGL at 19x forward earnings late last year. I think YouTube is undervalued and represents the present and future of media. I bought Amazon at a similar time at a fair price. AWS is incredible and their logistical moat is unmatched.

PLTR is a good company, but has a quite expensive valuation, even when I bought it at ~$11 per share. The purchase was a departure from my typical process, but I feel good about it. The company is strongly positioned in the domestic and international government/defense sector, is rapidly growing its commercial sales, and is becoming increasingly profitable. AI is not a new concept to this company, and they’re positioned to take advantage. They have a strong leadership team and technologists and an incredible stable of backers.

The dearly departed: Since my post last year, I sold UPAR, QVAL, IVAL, and AVGE to reshape the portfolio in its current form. They’re all great funds, but the opportunity cost of holding them was too high relative to what I’ve added. I don’t expect much portfolio turnover over the next year.

Thanks for reading. Until next year.