What does this chart show?

The 1-year rolling correlation between stocks and bonds has been mostly positive over the last ~75 years, and over the last few years we have exited a ~20 year period of negative stock-bond correlations.

Why does it matter?

The modern asset/wealth management industrial complex has been built over the last 20-years in a low and stable inflation environment where bonds have hedged stocks - hence the rise of the 60/40 stock/bond portfolio. The jolt of the COVID pandemic and the accompanying monetary and fiscal response have increased inflation volatility and turned the stock-bond correlation positive, towards historical norms.

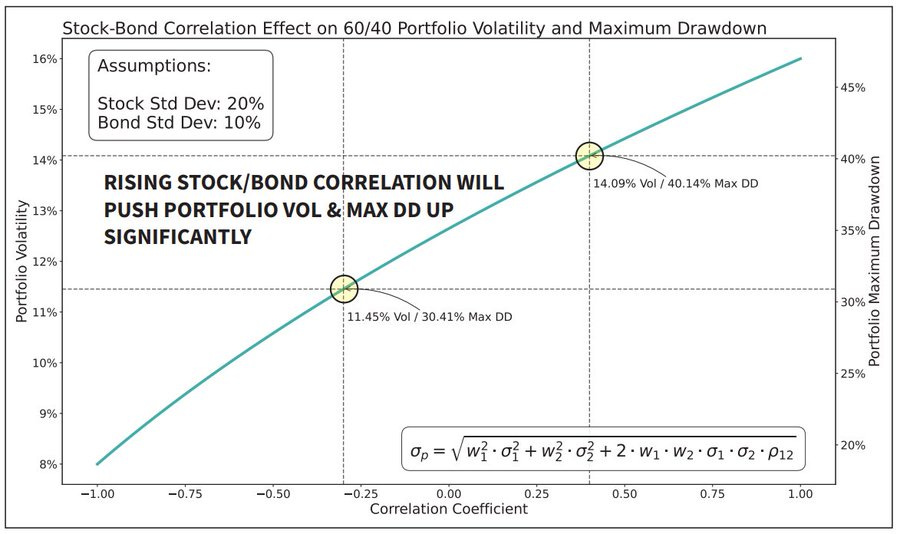

When the stock-bond correlation is positive, overall portfolio volatility and drawdowns increase1.

The Bottom Line

Acknowledge that you can’t predict the future environment, but you may be able to prepare by holding assets with a historical record of low correlation to both stocks and bonds along with standout performance in regimes of a positive stock-bond correlation, like gold and real assets.

Chart Source - Bridgewater Associates