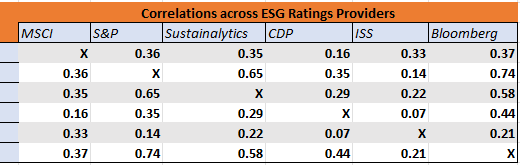

What does this chart show?

The major ESG ratings providers have low to moderately positive correlations between their respective ratings. 40% of the observations have a correlation below 0.29.

Why does it matter?

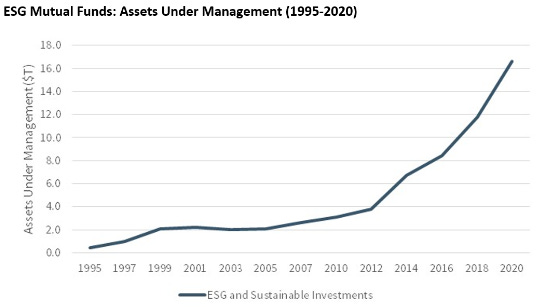

Trillions1 of dollars have poured into ESG funds over the past few years. Often the construction of these funds is informed by ESG ratings that are intended to measure a companies’ ESG quality.

In pursuit of this measurement, two camps have generally emerged. The first camp, the doing good camp, attempts to assess the impact a company has on the welfare of its stakeholders. The second camp, the risk mitigation camp, attempts to assess the impact that societal and environmental factors have on the company, and that these factors are financially material.

These subtle but important distinctions then impact how providers create ratings. Most impactfully it results in differences in the scope (the attributes providers are trying to measure), in the measures used to evaluate those attributes, and in the weightings assigned to attributes which reflect their perceived importance.

The Bottom Line

ESG quality is a judgement that rests in the eye of the beholder and is of unproven importance to investing returns. ESG ratings attempt to distill broad and fundamentally different categories into a single score, so it’s no surprise the ratings vary widely.

At best, a triangulation of ESG ratings can provide a broad sentiment check on a companies’ ESG quality. At worst, ESG ratings are confusing (Tesla isn’t ESG?) and misleading - FTX had a higher leadership and governance score than ExxonMobil.

Chart & Data Sources - ESG Ratings: A Compass without Direction