Chart of the week

Darkest before the Dawn

What does this chart show?

The performance of many of the most widely followed fixed income indices has been dismal over almost every conceivable time period over the past decade before accounting for taxes and inflation.

Why does it matter?

Bonds are routinely positioned as the ‘safe’ asset in investors' portfolios, useful for their yield and ability to provide diversification and ballast to stocks.

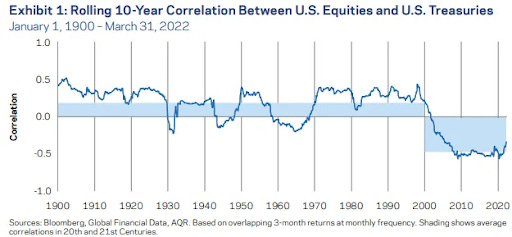

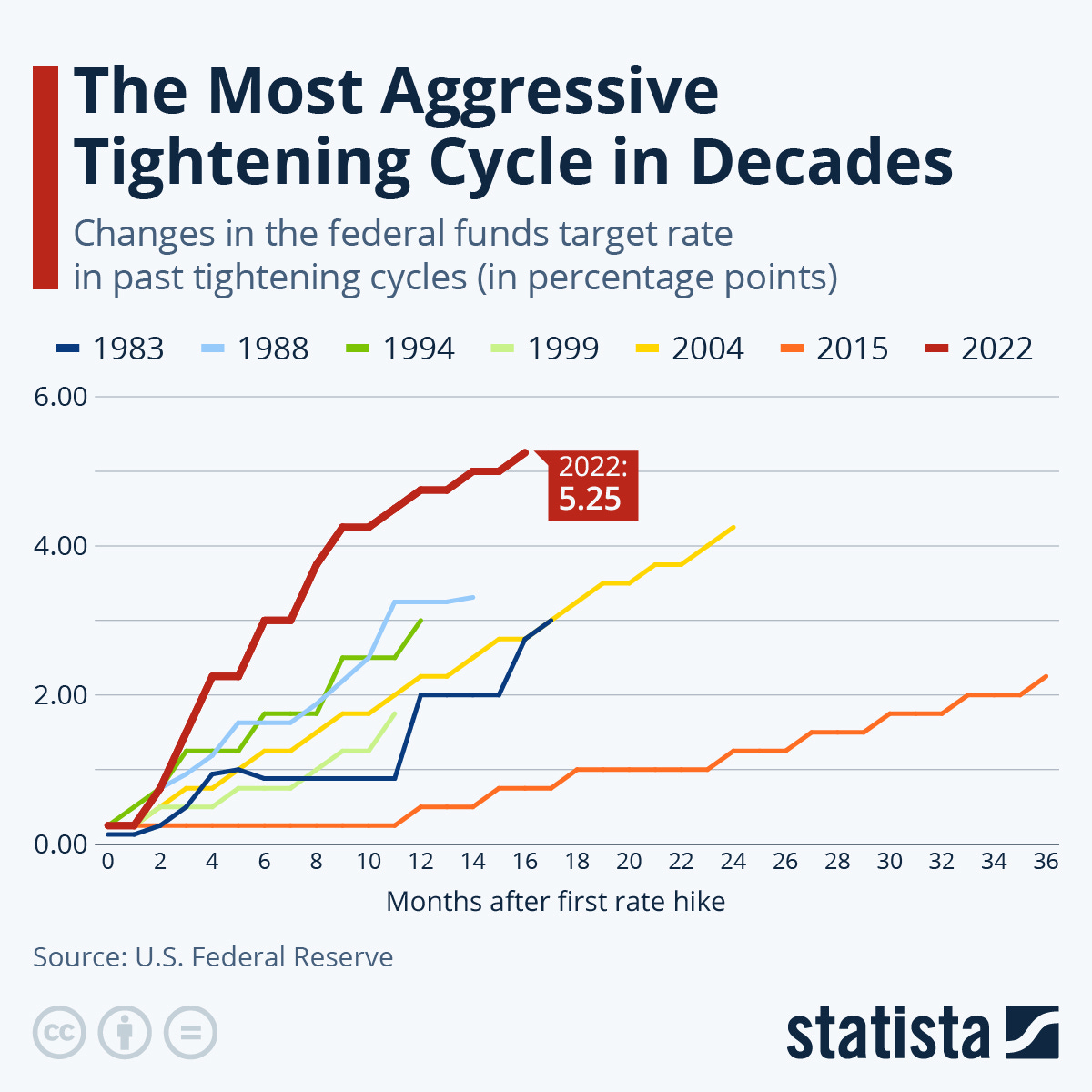

During the golden age of bonds from 1982 - 2014, they benefited from a 30-year period of declining interest rates1 and atypically negative stock-bond correlations2. The last decade has been far less kind, as we experienced one of the fastest interest rate hiking cycles in history3 and the return of higher inflation uncertainty post-COVID which impaired bond performance. Now, investors are questioning the role of bonds in their portfolios as it has become clear there is nothing low risk about owning bonds.

The Bottom Line

Bonds continue to play a role in a diversified investors portfolio and they perform best when growth and inflation are decreasing relative to expectations; but of course we don’t and can’t know when that will happen again. It’s darkest before the dawn for bonds.

Chart & Data Sources - FactSet