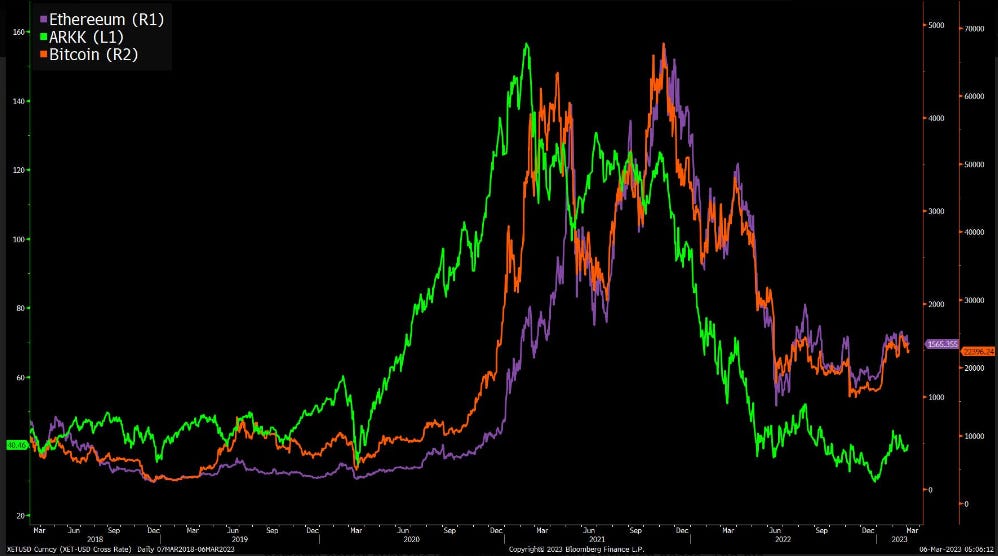

What does this chart show?

Since 2018, Bitcoin and Ethereum have been highly correlated to investments in speculative and profitless high growth businesses, proxied in this chart by ARKK.

Why does it matter?

This chart contradicts the common narratives around the crypto ecosystem that have been used to justify speculation from retail investors and as long-term theses for true crypto believers.

Narrative #1 - Bitcoin is an inflation hedge: During the inflation surge of 2022, Bitcoin returned -65%, beating out Ethereum, down 69%.

Narrative #2 - Bitcoin is a store of value: It has ~5x the volatility of the S&P 5001.

Narrative #3 - Crypto is a portfolio diversifier: It actually trades like high beta equities.

Narrative #4- Bitcoin is digital gold: Gold served as a store of value in inflationary 2022 (-1% in USD and positive returns priced in alternate currencies)2 and during the COVID systemic risk drawdown of 2020. Because of the failures of narratives #1, 2, and 3 it appears gold offers more value to a portfolio, at least for now.

Narrative #5 - Crypto is trustless and permissionless: To practically turn your crypto into dollars you need a “fiat off-ramp”, therefore you need to trust a crypto exchange. Yikes. The unregulated ones have mostly been incinerated during the time period shown in the chart, and now a prominent, regulated crypto bank, Silvergate, looks like it’s on death's doorstep.

The Bottom Line

Crypto still appears to be a tool for speculation that trades like a levered NASDAQ. It remains to be seen what value it may bring the world. As Josh Brown says, “The largest entities in the crypto ecosystem, despite last year’s 1929 moment, are still the brokerages and exchanges. There is nothing else worth talking about. If there are brilliant entrepreneurs in the space who have built useful crypto things suitable for mass adoption, where are they? Who are they? Why are we not hearing more about them? In their absence, we have nothing to focus on other than crashed prices and international scandals.”

Chart Source - Bloomberg's Joe Weisenthal