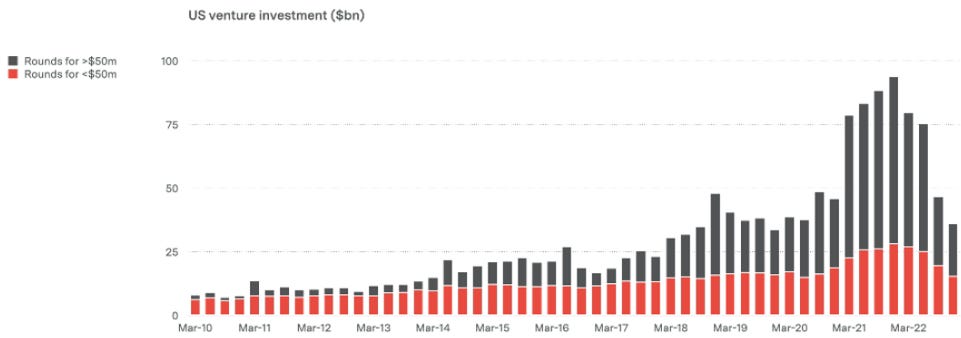

In 2021’s speculative frenzy, over $300bn was invested in venture capital, double the amount of 2020 and nearly 10x the level of a decade ago1 . Conventional finance wisdom says that as capital chases performance, and valuations are bid to unfathomable levels, expected returns will be diminished, but the music was on and allocators were dancing. In 2021, the median valuation for a late-stage software-as-a-service company was 114x annual recurring revenue2 .

On valuation, expert Michael Mauboussin says, "The most important question in investing is what is discounted, or put slightly differently, what are the expectations embedded in the valuation? Understanding what has to happen for today's price to make sense is just such a fundamentally attractive proposition. And then evaluating whether you think that those growth rates in sales and profit margins and capital intensity and return on capital that's implied, whether those things are plausible or not, it just makes enormous sense as an approach.”3

It’s hard to understand the level of expectations embedded, for the economy and companies, based on the level of investment at such valuations, but the reckoning is likely just underway for recent venture capital vintages. If you use ARKK as a rough public market proxy (now back at 2018 levels) things don’t look good4. None of this should be surprising, though, our human tendency to imitate, extrapolate, and chase performance at any cost is maybe our most predictable and deeply rooted bias5.

Chart Source - Benedict Evans’ tremendous presentation, The New Gatekeepers

Observation from Antti Ilmanen, Chapter 17 of Investing Amid Low Expected Returns