Chart of the week

Returning to the scene of the crime - the 2022 bond massacre

What does this chart show?

Global bonds lost 31% in 2022, the worst annual performance for fixed income dating back to 1900 according to the 2023 Credit Suisse Annual Investment Returns Yearbook. Globally, the average annual real bond return since 1900 is 0.6%, bolstered by the 40 year bull market in bonds beginning in 1982.

Why does it matter?

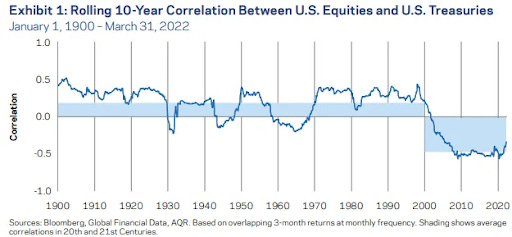

Bonds are routinely positioned as the ‘safe’ asset in investors' portfolios, ‘ideal’ for their yield and safety. Over the past 40 years they have been great due to a period of historically exceptional negative stock-bond correlations1 and persistently declining interest rates2. This came to a screeching halt last year.

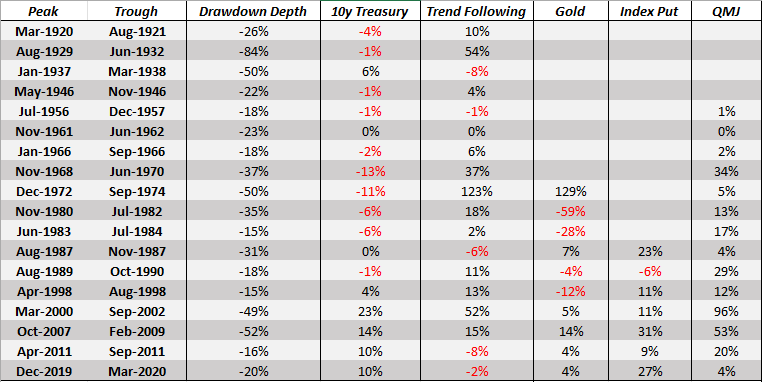

Zooming out reveals that global real bond returns have been flat for 100+ years. U.S. bonds have fared slightly better with a 1.7% annual real return. Importantly, though, in 18 of the largest S&P 500 drawdowns from 1920 - 2020, bonds had a flat or negative return 67% of the time3. In sum - little return, unreliable safety, and the same vulnerability (inflation).

The Bottom Line

“Failure comes from a failure to imagine failure” - Josh Wolfe

Relying upon bonds to repeat their performance of the recent past rebuffs history. Make your portfolio more durable to an unknowable future by adding assets that have historically and academically proven their value - commodities, gold, and TIPS along with strategies like trend following.

Chart & Data Sources - 2023 Credit Suisse Annual Investment Returns Yearbook and the Financial Times