Chart of the week

Are European stocks losers for good?

What does this chart show?

For 40 years, from 1970 to 2009, the S&P 500 grew at 9.87% annually, and MSCI Europe at 9.88%. When the S&P 500 posted zero return from 2000-2010, MSCI Europe posted positive returns.

Why does it matter?

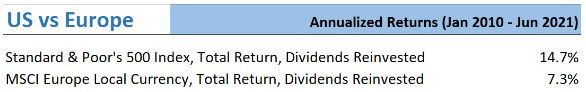

Despite the historical record, U.S. investors have generally fled from investing internationally1 over the last decade, and in Europe particularly, as U.S stocks have slaughtered2 all competitors since 2010. The recent performance of the S&P 500 raises the question of whether there has been a paradigm shift that’s made investing outside of the U.S. a losing bet.

Arguments in favor of continued U.S. dominance cite our relative political stability, energy independence, friendly neighbors North and South, and our penchant for technological innovation and entrepreneurship - all compelling arguments for a valuation premium, despite no historical precedent. A deeper dive reveals that the composition of the U.S. market, ~26% weighted in technology vs ~7% for Europe, has driven much of the outperformance during a decade of low inflation and interest rates. Further, Europe has been plagued by continuously negative headlines from the European debt crisis, to Brexit, and later to Ukraine that’s fostered pessimism.

The reality is that an investor now can buy a dollar of earnings from European companies at a ~30% discount to their U.S. counterparts, and get ~twice the dividend yield3.

The Bottom Line

If markets mean revert, and if valuation ever matters again, future prospects for European stocks are better than for U.S. stocks. For those seeking investment outperformance, European value stocks are exceedingly cheap and worthy of consideration if in fact the world hasn’t changed for good, but be prepared to look different. The run may have already begun…

Chart & Data Sources - Josh Brown & Michael Batnick and Drew Dickson

(This is dated but still directionally correct).