Chart of the week

Meme nation

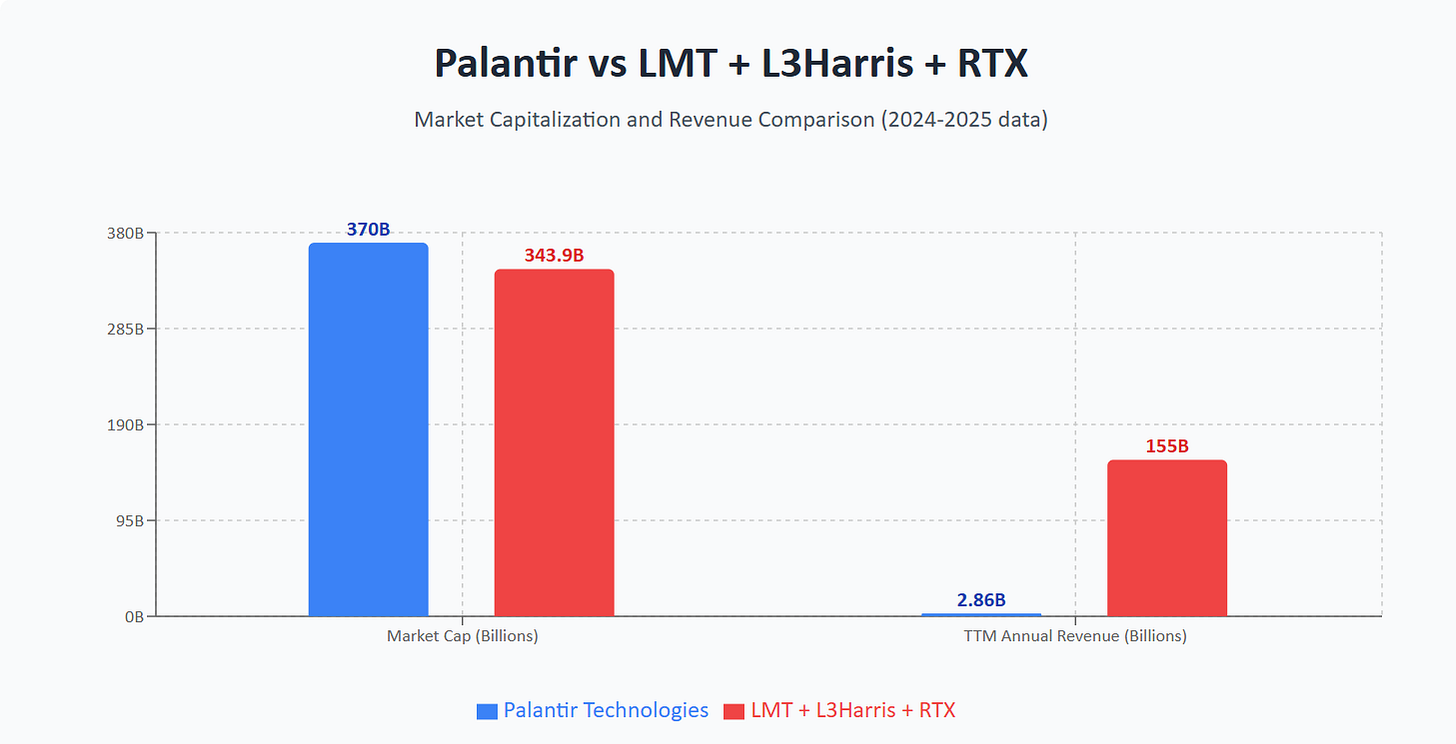

What does this chart show?

The market capitalization of Palantir is ~$20B greater than the combined market capitalization of Lockheed Martin, L3 Harris and RTX Corporation while having 2% of the annual revenue of the combined three.

Why does it matter?

The helicopter money COVID period seems to have ushered in a sustained period of gambling/meme stock activity that has driven certain stocks to unbelievable heights. While many of the meme stocks are companies with promising technology, like Palantir, the key characteristic of these companies is that they have a charismatic leader with a mastery of modern communication tactics and methods. They go direct to end stock purchasers with comedy, promises, and always position themselves as the underdog.

So far, investors have done well with Palantir, as it has sported a 79% compounded annual growth rate since IPO in 2020, but the more important part is likely the distorted behavioral patterns and expectations that participating in lottery stock winners like Palantir can engrain.

The Bottom Line

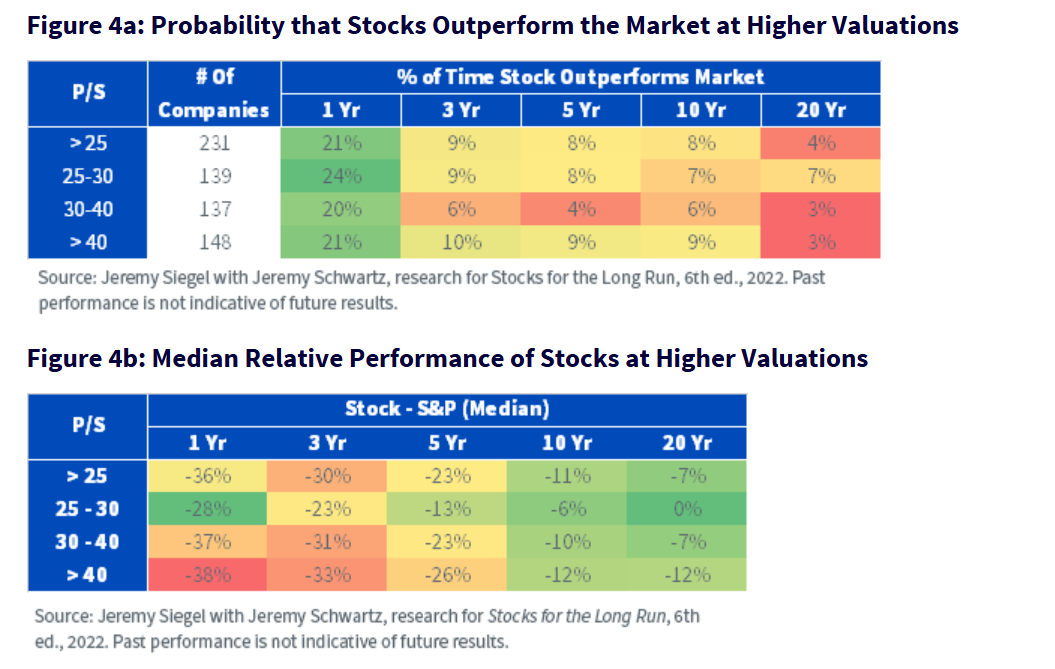

Buyer beware, there is no precedent for sustained forward outperformance of stocks valued like Palantir1 (currently at 120x price-sales ratio).