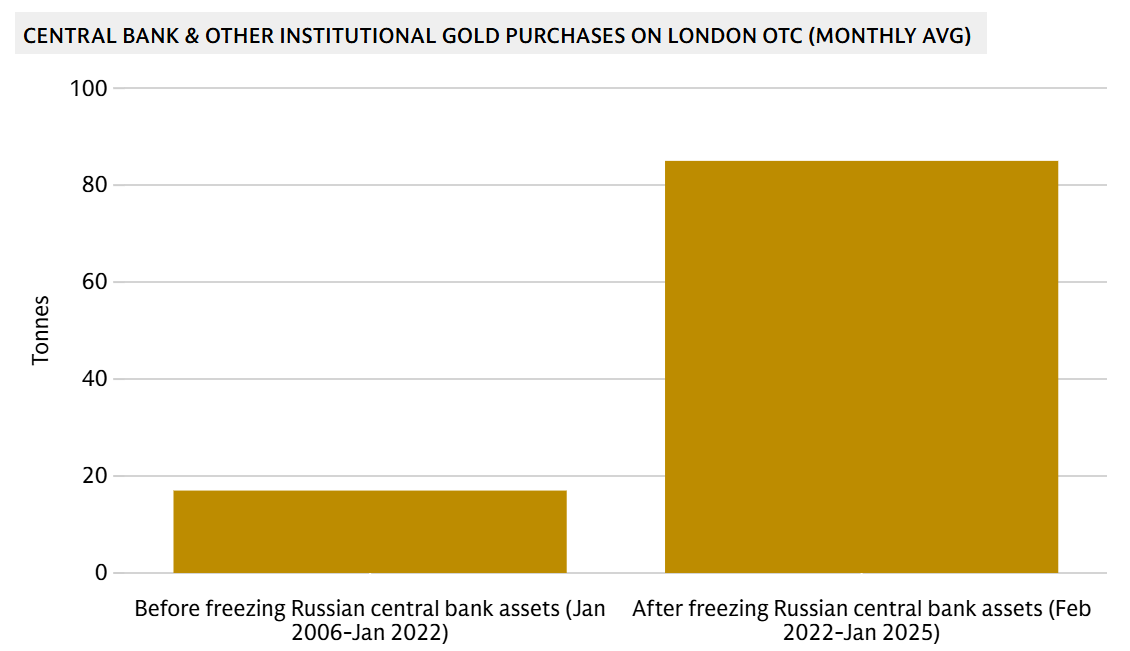

What does this chart show?

Since 2022, the monthly average of gold purchases by central banks has increased 5x over the prior 15 year period.

Why does it matter?

After Russia’s 2022 invasion of Ukraine, Western governments froze ~ $300 billion of the Bank of Russia’s foreign reserves. In the period since, central banks have been buying gold at a torrid pace.

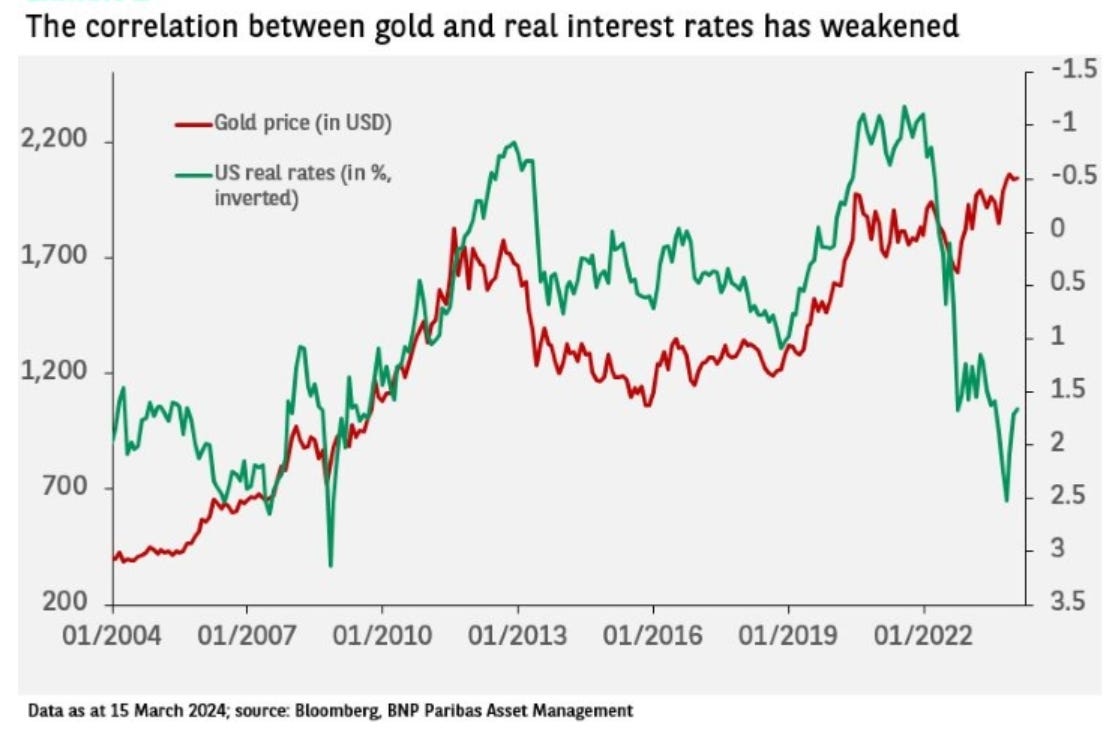

This dynamic has led to a bull market in gold, as gold prices per ounce have nearly doubled over the last three years to $3,350/ounce. Notably, the performance of gold over this period has departed from its long held inverse relationship between its price and real interest rates1. As Radnor Capital says, perhaps the best way to think of the price of gold is 1 / T (T = trust in institutions and world order).

The Bottom Line

In a world of continued fiscal recklessness and geopolitical strife, gold provides sovereign nations autonomy and individual investors an excellent portfolio diversifier with hundreds of years of history.

Chart and Data Sources - Goldman Sachs, Why gold prices are forecast to rise to new record highs