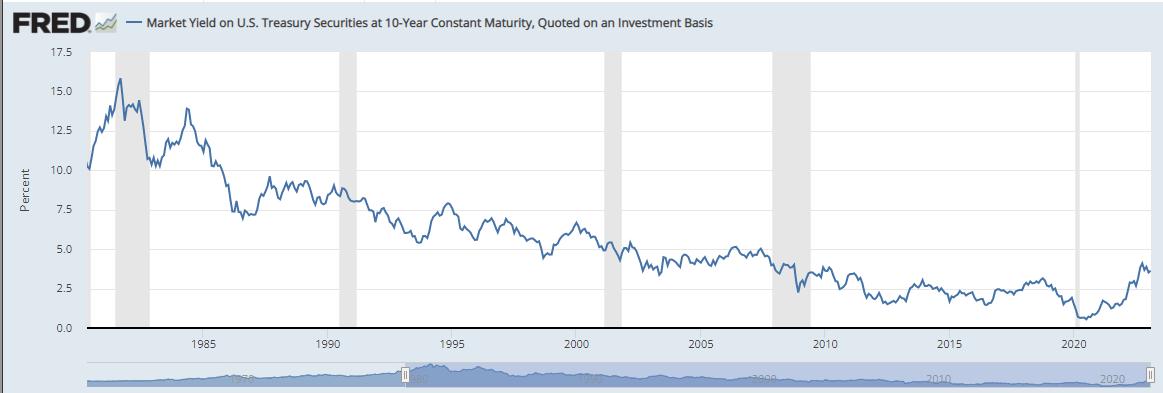

The 60-40 portfolio benefitted from a 40-year bond bull market1 from 1981-2020 and a historically exceptional period of negative correlation between stocks and bonds. This setup was great for the portfolio and it became widely adopted and recommended. But bad (or suboptimal) decisions don’t always have bad outcomes just like good decisions don’t always have good outcomes. Is the decision to invest in a 60-40 portfolio over the past decades just an example of luck - a suboptimal decision that had a great outcome?

Investing in a 60-40 portfolio is a suboptimal decision because:

It is unprotected against periods when inflation is rising or exceeds expectations which has happened frequently throughout history2. By their nature, stocks and bonds both perform poorly in these environments (last year).

It is a bet on particular economic environments transpiring - environments of rising growth and falling inflation or falling growth and falling inflation, the exact environments of the past two decades3. History tells us it’s unlikely the next 20 years will unfold like the last.

It isn’t actually ‘diversified’. 90% of the risk in the portfolio lies in the 60% allocation to stocks4. The bonds used in the portfolio are not volatile enough to offset stock declines. If your ‘diversified’ portfolio is down across the board, it isn’t well diversified.

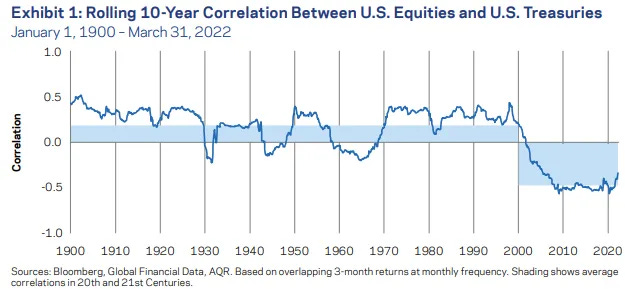

It relies on bonds being uncorrelated to stocks, but the past 20 years have been an anomaly as shown in the chart above5.

It can easily be improved while improving returns and decreasing drawdowns.

The good news is that investors can take the lessons of history and last year as a sign to make their portfolio more durable to an unknowable future. Assets like TIPS, gold, commodities, and strategies like trend following6 have proven to perform during the periods when the 60-40 is most vulnerable while not surrendering returns in good times. Or consider the simple framework put forth by Harry Browne, the founder of the ‘Permanent Portfolio’7. He advocated for a portfolio of stocks, bonds, gold, and cash in equal proportion to be prepared for all economic environments. A backtest of the Permanent Portfolio against the 60-40 (in perhaps the best period ever for the 60-40) reveals that it nearly matches the return while cutting the max drawdown in half.

Thoughtful diversification and thinking differently is powerful. It’s great to be lucky, but it’s better to repeatedly make good decisions.

Note - The 60-40 portfolio isn’t ‘dead’ or even bad. Entry points for both stocks and bonds are better than they’ve been in over a decade, and anyone with an investment plan is better off than someone without one. It’s just suboptimal.